If you are an investor and have seen a lot of changes in your portfolio lately, you might be a little bit confused. Some days you end up green on the day (profitable), but on others, your account goes down. Then, on the next day, you are green again! Isn’t crazy?

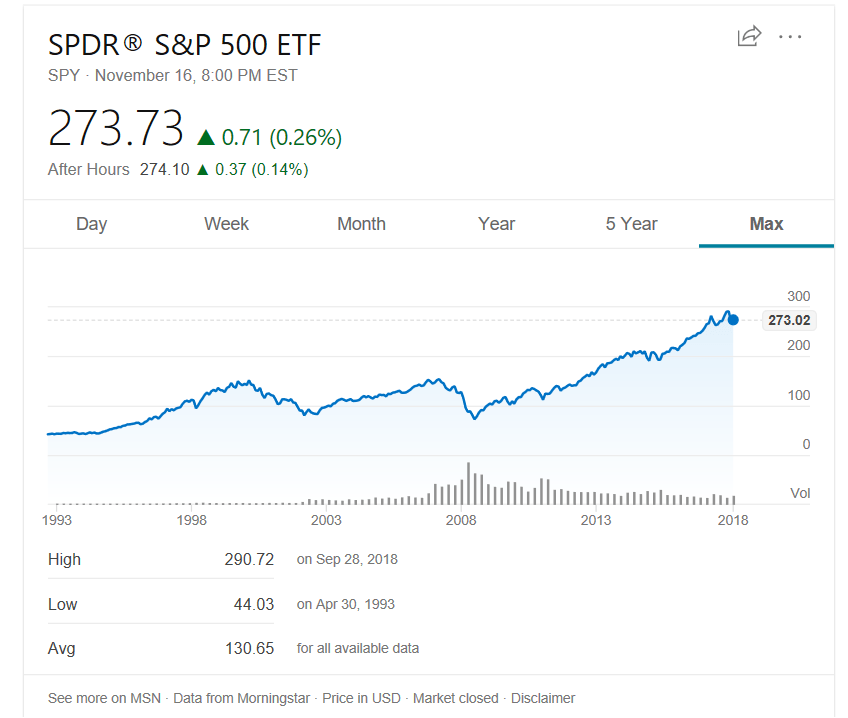

The recent market madness has the Dow Jones (which measures 30 of the biggest stocks) moving up and down in a strange way. These changes in the market price are nothing new to the scene. Nevertheless, the unusual part is the lack of volatility we have seen in the past year in the market. For instance, $VIX, a ticker symbol that measures market volatility, last year hit an all-time low. Historically, October has been the most volatile month of every year until 2018.

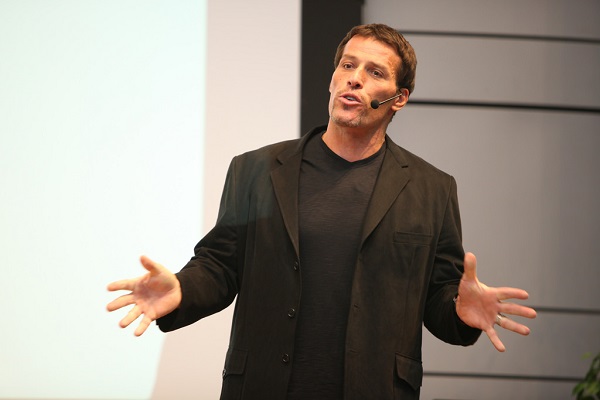

On February 5, 2018, the Dow dropped tremendously, however, the next day it began to pick up the pace, and by the end of the month, it recovered all of its loses this way ending the month strong. This was known as a correction period. Based on previous corrections the stock market has been able always to recover its losses after every significant drop. Self-made billionaire Tony Robbins said the following about the importance of a correction, “why does this matter? Because it shows you that corrections are just a routine part of owning stocks. Instead of living in fear of corrections, accept them as regular occurrences. Historically, the average correction has sent the market down 13.5% and lasted 54 days — less than two months.”

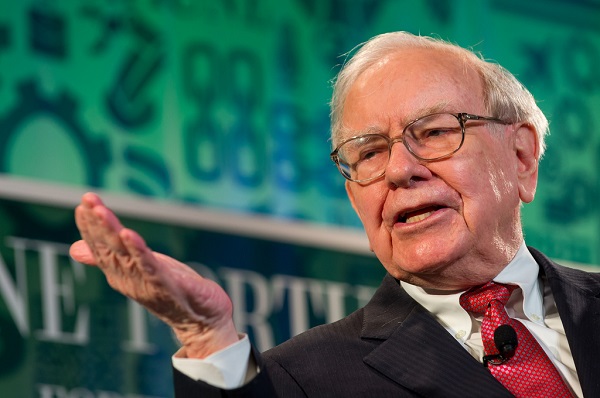

Even with the ups and down this year the market continues to grow and has been doing so for ten years which makes it the longest of all bull markets. The call to action for any investor is to be patient and to avoid any emotional decisions that may affect their portfolio. Also, another recommendation is to be selective from where they obtain their financial advice the source of information is crucial through times like this. After all, every single market downturn has historically ended in an upturn! As Warren Buffett has said, “The stock market is a device for transferring money from the impatient to the patient….. If you lose money in the market, it’s because of a decision you made — and if you make money in the market, it’s because of a decision you made.”