Born in Arizona, Ricky Gutierrez always had a passion for entrepreneurship and helping others. Thanks to his parents from an early age Ricky understood the value of the dollar and how vital it was to both purchase the things you needed but most importantly, how it could be used to help those around you.

His journey as an entrepreneur started when he was a kid in middle school where he began making fingerboards as a hobby. At the time, fingerboards were popular, and with the help of a friend, they started building fingerboards to sell them at a lower price. Although it was a team, Ricky’s partner eventually stopped working on the project which left Ricky all by himself. Instead of losing hope he worked even harder to keep the business afloat which ultimately led him to win some customers.

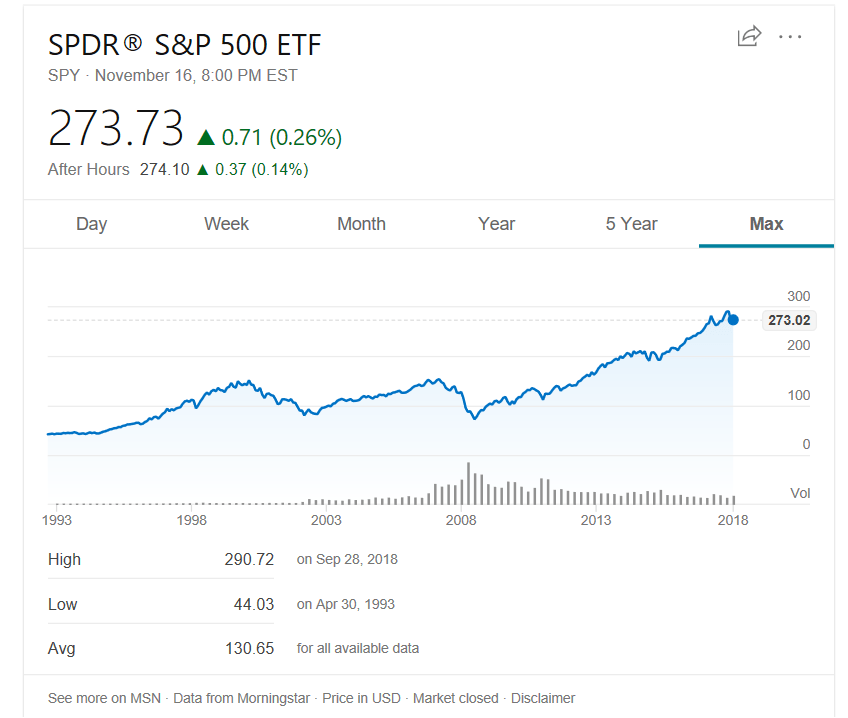

Once in High School, Ricky began to look for new ways of making money so he could buy things he needed without having to bother his parents who already had a lot on their plate. After many months of trying different things, Ricky came across a guy from Connecticut while surfing the Internet that became a millionaire trading stocks while still in college and here is when Ricky discovered the world of trading.

After educating himself in the world of stocks Ricky decided to open a brokerage account but had one issue —he was still a minor—. For a minor to open an account with a broker, they must receive the consent of their parents/legal guardians. After having a conversation with his parents, he was finally able to open and fund his first brokerage account this way beginning his journey as a trader!

Even though Ricky was very excited to start his journey as a trader he soon came across the massive wall that is to become successful in the industry “90% of traders lose money, and only the top 10% prevail.” Like many new traders, Ricky didn’t take this warning seriously and eventually began to lose money. After a couple of months of trading, Ricky blew out his trading account!

Although it was disappointing to lose most of his starting capital, Ricky used his failure as a driven force and by staying disciplined, finding a niche, and waiting for the right setups he became comfortable and made better decisions in his trading. After trying multiple strategies and trading styles he began to distance himself from his losing past and started to embrace his new consistent style of trading.

After finding consistency and a new found passion for trading, things began to change with Ricky. Even though it was fun to make hundreds of dollars while trading just a few hours a day Ricky felt there was more in life than living for yourself, he needed a purpose! After some time Ricky began to create YouTube videos to show others how to trade, something he did for fun, however, life had another plan for him.

After uploading videos on a consistent basis, the views on his channel began to grow alongside his subscribers, and little by little his channel began to flourish. Even though the attention was good, what Ricky enjoyed the most was answering different questions from people all over the world asking him about trading and how he got started. After many months things finally came together and with this, Ricky’s purpose came to life…Teaching.

A newfound purpose for educating others and a growing following each day, the next step for Ricky was to create a community in which he could closely mentor people from all walks of life this way founding “Techbud Solutions” in 2017. Techbud Solutions is a group designed to help motivated people to connect with one another to further assist and expand their ventures. Fast forward to September of 2018, Ricky Gutierrez has become the youngest millionaire in Gilbert, Arizona. Also, expanded his entrepreneurial quest to not only the stock market by becoming the owner of different business such as real estate, buying & selling high-end vehicles, and his learn plan profit lesson library which teaches you step by step how to become a consistent and profitable trader.

Thanks to his determination and genuine interest in helping others, he has now over 300,000 subscribers on YouTube, 140,000 follows on the official Techbud Solutions Facebook page and over 50,000 followers on his personal Instagram account. His integrity and willingness to help others helped him develop a strong bond with his followers whom each day grow by the thousands. Some may think he just got lucky but for those who have followed his journey for the past two years, can assure that all we have seen is nothing but the true definition of discipline and consistency.